Introduction:

- During the pandemic, household care products - especially ones concerning sanitization - flew off retail and online shelves. Having met then consumer demand, industry players now must brace for new expectations with new market outlooks as Malaysia enters an endemic phase. As restrictions are easing, vaccination rates increasing and fears subsiding, consumers' behaviour is expected to go through another major shift.

- Household care products are ubiquitous, so it is often challenging for brands to stand out through their marketing strategies. Coupled with a myriad of challenges such as price hikes, sustainability concerns, and arraying product choices, there is no telling what can turn consumers into loyal customers.

- This article unearths five consumer truths that household care brands need to pay attention to. These truths are derived from a consumer survey launched on Vase.ai’s Every, an artificial intelligence-powered consumer research platform, in March. The survey received responses from a total of 531 Malaysians. Read on to find out information about consumer behavior and brand choices in floor cleaners, dishwashing, and laundry detergent to help companies keep up through product innovation and effective marketing strategies.

Survey details:

Truth #1 - Consumers DO NOT prefer buying online. 86% of consumers prefer buying household care products in-store.

A large portion of consumers (86%) prefer to buy in-store while 45% prefer to buy on retailer websites. E-commerce platforms saw 44% of consumers with Shopee being mostly preferred (74% or 79 out of 107 respondents) and followed by Lazada (35.5%).

This finding can be attributed to the ease of restrictions that allow consumers to go out more often, thus reverting to their pre-pandemic expectations. However, digital transformation continues to disrupt the retail sector as online purchases become normalized. To continuously meet demand, marketers must be able to adapt by smartly distributing the budget in channels that target audiences are more likely to use.

Truth #2 - Consumers listen to social media influencers. 41% of consumers would buy products recommended by social media influencers.

During nationwide lockdowns in 2020, household care brands saw a stark increase in cleaning products purchases over concerns of the spread of the virus. Consumers also spent more time on social media. As a result, they are more receptive to trying out products used in the online content they consume. In our survey, 41% of respondents will likely buy products recommended by social media influencers with only 12% won’t. Our findings also show that single male respondents are more likely to be less influenced, followed by Chinese respondents. Piggybacking on the trust of influencers can help marketers reach consumers in more targeted, engaging ways. If consumers feel confident about an influencer's

Download our latest consumer insight report on the household care industry!

Truth #3 – Not all consumers are eco-conscious!

57% of consumers who are married with children are concerned with environmental impact.

While it is safe to assume that Malaysians generally have some level of environmental awareness, household care marketers face obstacles in crafting messaging that matters. Our study found that among different consumer segments in Malaysia, consumers with children (57%) are the most concerned when it comes to the environmental impact of packaging. This finding alludes that they are concerned about their children’s future and therefore, more susceptible to undertake initiatives that drive long-term impact.

Truth #4 –Consumers wouldn’t mind paying a premium

60% of consumers opt for expensive floor cleaner options.

Our study also found that more than 60% of consumers buy more expensive options of floor cleaner and dishwashing brands despite placing greater importance on the aspect of price (80%) than brand (45%) when making purchase decisions. Indeed, low prices attract, but there are many varying factors that make consumers willingly pay more, especially when it comes to brands with strong image. Riding on this insight, brands should build on strong brand image by further leveraging consumer research to succeed in their niches.

Truth #5 –Consumers are somewhat loyal to brands

In the past 6 months, consumers have been using the same household cleaning brands.

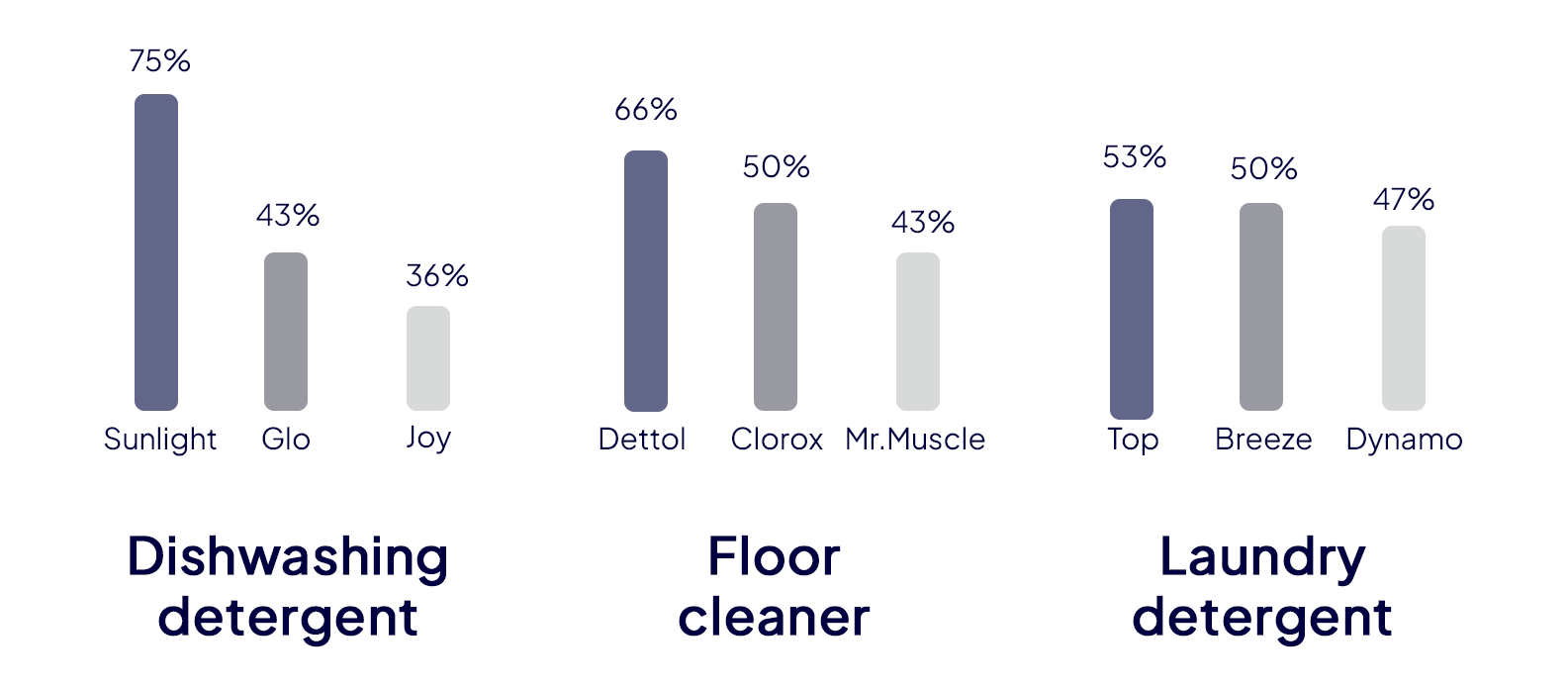

Household care brand choices are plentiful in the market, but our study suggests that consumers buy specific dishwashing, laundry detergent and floor cleaner brands. The table below illustrates the top 3 preferred brands across consumer segments.

Table: Top three brands of dishwashing detergent, floor cleaner, and laundry detergent.

Question: Which of the following brands have you been buying for the past 6 months and will likely continue buying?

This could also be owed to habitual buying behavior in which consumers continue to buy particular brands without much thought. What does this mean for emerging new brands? How can they be considered as equal competitors to established brands in the industry? The answer lies in running consumer market research to understand their target customer’s attitudes and preferences. In return, they can develop winning go-to-market strategies.

Handling the Truth – Like a Pro

Today's consumers think in a new way. It affects what they buy and how they feel about household cleaning products. In already highly competitive market, household care brands need to keep a pulse of their target customers to:

- Adapt to demand by smartly distributing budget in channels where target audiences are more likely to use

- Find out what (or who) influences their purchase decisions

- Craft messaging that matters to different customer segments

- Build stronger brand image that in turn strengthens brand loyalty

Read our report for more key insights from this research.