Previously, we talked about the increasing importance of adopting a Consumer-First approach to decision making caused by the rapid change in consumer behaviour. Here, we dissect how to measure the performance of your marketing efforts the Consumer-First way.

Before we start our journey on implementing Consumer-First Marketing, we will need to define what metrics we're measuring. This post will help you answer the age-old question “What is the ROI?”

In a for-profit organisation, no matter your immediate objective, gaining more sales, resulting in profits, is the ultimate end goal. But sales data as a measurement shows only a fraction of the picture.

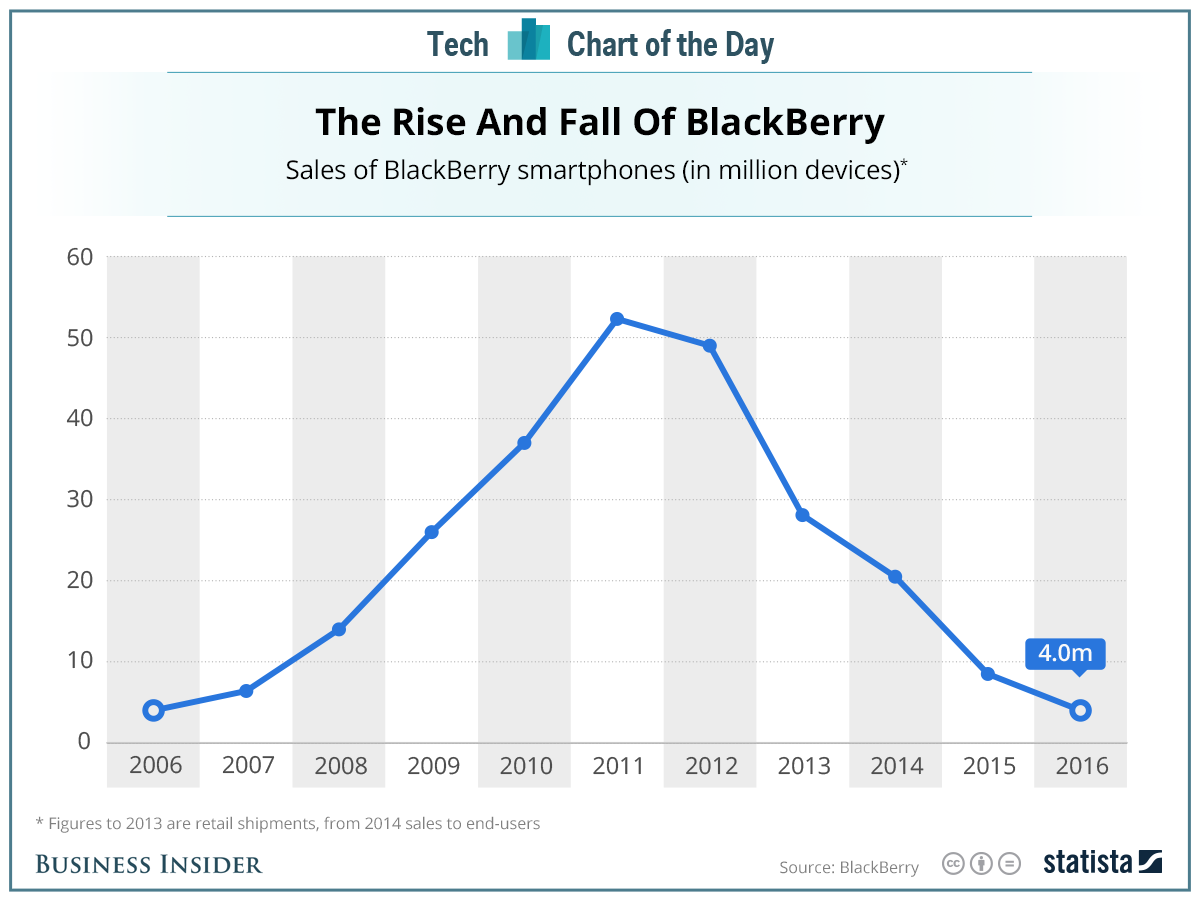

What’s scary about the chart above is that iPhones were introduced on January 2007, the start of the chart, and sales for BlackBerry continued rising for the next 4 years before it started its rapid decline.

Sales data is a lagging indicator of consumer preference. In a Consumer-First world, basing your strategy on sales data will kill your business.

When consumers are the de facto kingmaker, measuring your marketing efforts need Consumer-First measurements.

What then, is the leading indicator of consumer preference?

Introducing Brand Tracking Research

Brand Tracking Research is how leading organisations track the performance of their brand, find gaps, and exploit opportunities to win consumers’ loyalty. It’s the Consumer-First way to measure performance, by asking what consumers feel and know about your brand.

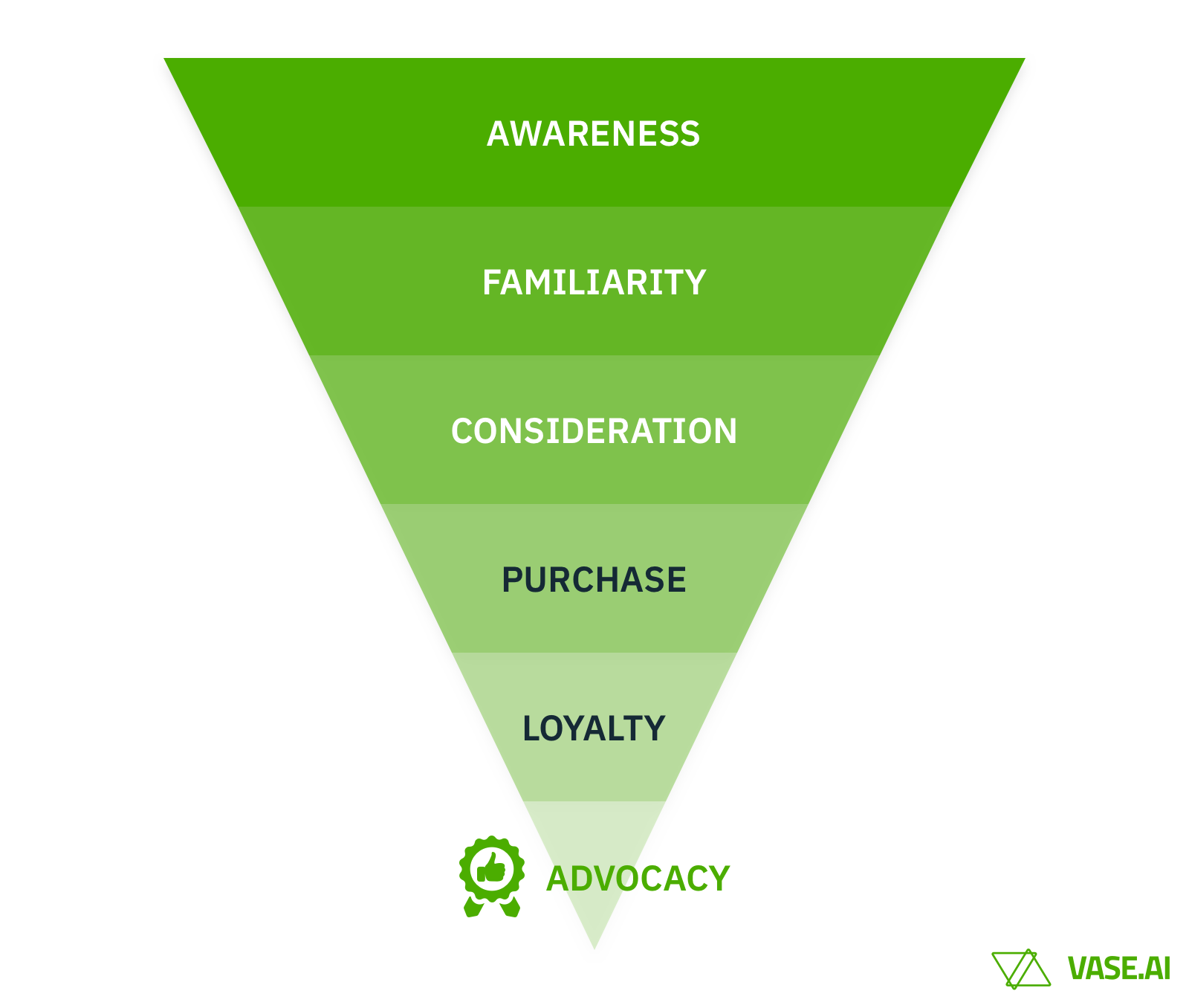

Although brand trackers are slightly different across industries, there are general frameworks that can be applied throughout. Here are some of the questions brand trackers can help answer:

- [Metric: Unaided brand awareness] How many % of my consumer base think of my brand first when it comes to my category?

- [Metric: Aided brand awareness] How many % of my consumer base are aware of my brand?

- [Metric: Brand/Product familiarity] How many % of my consumer base is familiar with my brand?

- [Metric: Brand consideration] How many % of my consumer base will consider my brand when making a purchase?

- [Metric: Brand loyalty] How many % of my customer base are die-hard, loyal users of my brand?

- [Metric: NPS/Advocacy] How many % of my customer base will recommend my products/services to their friends and family?

- [Metric: Brand imagery and positioning] How do consumers perceive my brand image? Is it aligned with our brand positioning?

- [Metric: Purchase consideration] Among all consumers, if they were to buy a new product in my category, what would their first choice be?

- How are these metrics changing on a month-to-month basis? Are my marketing dollars effectively converting more consumers into loyal customers and advocates?

- How are my competitors performing against these metrics? Are they trending upwards in terms of converting consumers to loyal customers and advocates?

With these metrics set up in place, you will be able to track whether your marketing spend is effectively converting consumers into loyal customers and advocates, increasing overall customer lifetime value and turning your customers into your sales force.

You are also able to dive into different segments of consumers to see how does the funnel differ. Gen Ys may have grown up with your brand, but Gen Zs may no longer find it relevant.

Consumer-First Measurements drives innovation

Armed with brand tracking data, you’re able to see at which point of the funnel are consumers not converting to the next, and start acting upon it to improve your metrics:

- Low awareness? May need to invest more in mass marketing. Inform yourself of which mediums and channels to invest in to reach the right target audience with Consumer Media Behaviour studies.

- High awareness, but not converting to familiarity? Consumers may not understand your offering through your ads. See if consumers get the message of your creatives before investing in distribution with Pre-Campaign Advertisement Testing studies.

- High familiarity, but not converting to consideration? Consumers may not find your product offering relevant to them. Understand consumers’ consideration factors when buying a product like yours with Consumer Usage & Attitude studies.

- High consideration, but not converting into purchase? Consumers may not be able to find your product through channels they shop at. Understand which touchpoint do consumers go first when they think about buying a product in your category with Customer Touchpoint studies.

- High purchase, but not converting into loyalty? Consumers may not find your product useful after using it. Understand why consumers are not satisfied with your product with Product Evaluation & Satisfaction studies.

- High loyalty, but not converting into advocacy? Consumers may not have alternatives but to buy your product. Figure out customer satisfaction with Product Evaluation & Satisfaction studies. If customer satisfaction is indeed high, it may be time to invest in a Customer Advocacy Program.

Consumer-First Measurements keeps you informed of competition’s activity

Armed with competition’s brand tracking data, you’re able to see how consumers react to competition new product launches, rebrands, advertising, and more:

- Competition brand beating you at converting consumers from consideration to purchase? Identify consumer segments that purchased your competitor's product and learn the consideration factors that went into making the purchase with Customer Touchpoint studies.

- Is competition brand is growing purchase to loyalty conversion rapidly after they launch a new product? Uncover what consumers like about the competition’s new product and learn what you can do to one-up your competition with Product Evaluation & Satisfaction studies.